“The future of money is digital currency” – Bill Gates.

“Probably Rat poison squared. The idea that it has some huge intrinsic value is just a joke in my view” – Warren Buffet.

Two brilliant minds and two very different views on Bitcoin and Cryptocurrency. How could they be so far apart, you say. Well, in my humble opinion, it shows that there is more to play out in the Cryptocurrency market and that anyone who says they are an expert in Crypto or say, “Crypto is how you can make lots of money”, are exaggerating. It’s like saying an economist can predict the future!

So let’s do what I love best; let’s get the basics covered and then elaborate on the detail for those that want to go further.

What is Cryptocurrency or Crypto?

Oxford defines Cryptocurrency as a digital currency in which transactions are verified and records are maintained by a decentralized system using cryptography (The art of writing or solving codes) rather than a centralized authority like a country’s Central Bank. In other words, the records and verification of who owns Crypto and how much they own are verified and determined by a system that does not involve a bank or Government or regulatory authority.

The first of this Cryptocurrency is Bitcoin. At its conception, bitcoins are mined by sophisticated hardware that solves extremely complex computational math problems. The first to find the solution to the problem is awarded the next block of bitcoins, and the process begins again. This computational system is called Blockchain technology. Bitcoins are created out of thin air or “Mined”, and anyone can do it. That’s it.

Ridiculous, you may say, but that is how all currency initially started. When we print notes, the paper itself has no value, but we determined it to have a set amount of value.

Today quantitative easing does the same thing as Crypto-mining (which we will discuss further in part two of this article). A country’s Central Bank creates more of its currency electronically and circulates it into the economy via its banks. It’s also known as “printing money” even though it is not physically printing the money!

To understand Crypto better, we need to understand money. For money to have relevance, it must be valuable, and it must also have the following characteristics:

- A critical mass of people must have it

- Sellers of products and services must accept it as a form of payment

- The community or economy must have TRUST in it and TRUST that it will remain valuable.

IT’S ALL ABOUT TRUST!

In the past, products were bartered, such as food and tools, and the value of the goods was in the nature of the goods themselves and what benefits they could physically provide. If we consider something like Coins or Notes, we are talking about something physical, but you can’t gain much from the nature of the coin or the note. You cannot eat it or burn it to keep warm, so we must trust in its value and that it will remain valuable and hopefully stable.

Something like Credit takes a step further into the realms of trust and is only valuable if we trust the rules, regulations and society’s wish to comply with the “rule of law”. Otherwise, Credit is useless.

Now consider Cryptocurrency. It requires even more trust as a Central Bank, or the Government doesn’t back it to say that we will support it if the price goes down. So it’s used rarely to buy products or services, and not that many people own it compared to traditional money.

But all this is changing.

What is so good about Cryptocurrency?

The following are some arguments that have some merit:

- Sharing power and thereby reducing corruption – This is an interesting argument that has been stimulated by the increasing wealth gap we are finding in today’s societies. Instead of having one authority as the gatekeeper of money, there is a system where the network members hold the power. Cryptocurrencies aim to resolve the issue of absolute power by distributing power among many people. That’s the fundamental idea behind blockchain technology, which all Cryptocurrencies use.

- Limiting the ability to print too much money – As discussed, Government Central Banks can simply create or “print money” when they face serious problems such as what US, EU and Japanese banks are doing now. The argument is that this doesn’t solve the root cause of the economic crisis and is just a band-aid solution. Most cryptocurrencies have a limited, set amount of coins available. When all those coins are in circulation, it is very difficult or impossible in the case of Bitcoin to create more. This ensures the problem that caused the Economic crisis is dealt with.

- Giving owners complete control – Traditional money is controlled by Central Banks and the Government. If you trust your Government, that’s great, but at any point, the authority can freeze your bank account and deny your access to your funds. For example, look at Greece during its recent financial crisis. Some Governments can even simply abolish banknotes the way India did in 2016. With cryptocurrencies, you and only you can access your funds.

- Cutting out the middle person – With traditional money, a middleman like your bank or a digital payment service takes a cut each time you make a transfer. With cryptocurrencies, every blockchain network member is the middleman; their compensation is minimal in comparison.

- Serving the unbanked – Financial inequality is growing around the globe. Around 3 billion unbanked or underbanked people can’t access financial services. That’s approximately half the population on the planet! Cryptocurrencies aim to resolve this issue by spreading digital currencies and creating access to the most minute amount of a coin, depending on the Cryptocurrency you choose. For example, you can purchase 0.00001 of a Bitcoin or even buy an alt-coin valued at AU$0.000051.

Let’s go a little deeper.

Dispel some Myths

Cryptocurrencies are only suitable for criminals. Some cryptocurrencies have anonymity as one of their key features. In addition, most Cryptocurrencies are based on a decentralized blockchain, meaning a central government isn’t the sole power behind them. These aspects do make Cryptocurrencies attractive for criminals. However, citizens in corrupt countries can also benefit from them. For example, if a country’s Government or bank is untrustworthy because of corruption or political instability, the best way to store your money may be through Cryptocurrency.

You can make anonymous transactions using all Cryptocurrencies. Many people think Bitcoin is a secret, and nobody will know How much you have or what you have purchased with BitCoin. But Bitcoin, along with many other Cryptocurrencies, doesn’t incorporate anonymity at all. All transactions made using such Cryptocurrencies are made on the public blockchain. It’s actually the opposite and part of the TRUST element that makes Bitcoin more attractive. It is fully transparent, and anyone can view real-time Bitcoin transactions.

Risks of Cryptocurrency

There is no such thing as a sure thing.

If it’s too good to be true, it often is!

We have all heard these sayings, and it does not stop with Cryptocurrency. Whether you trade Crypto, invest in them, or simply hold on to them for the future (known as HODL in the Crypto space), you must assess and understand the risks beforehand.

The most significant risk with most Crypto is their volatility and lack of regulation, which is ironically why they are also liked. However, this threatens the aspect we discussed above around Trust and may limit the ability of Cryptocurrency to replace our traditional money systems in the future.

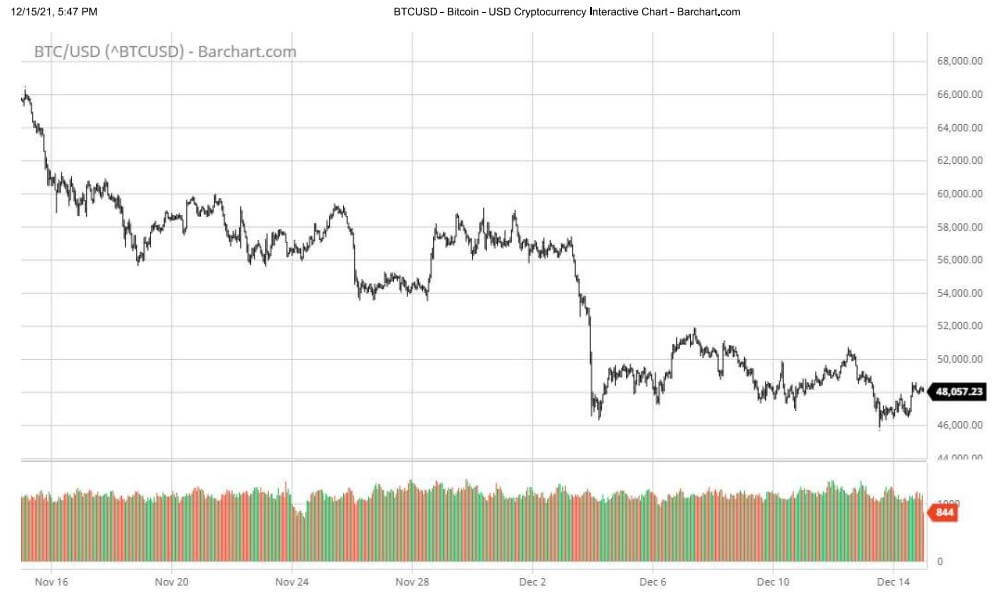

On Saturday 4th December 2021, Bitcoin shed 20% before recovering a little, which had it losing about $10,000 an hour. Including that drop, its value has declined about 29% since its all-time high on 8 November 2021, around the same time that speculative stocks started to slide.

The AUSTRALIAN TAXATION OFFICE and Cryptocurrency

The AUSTRALIAN TAXATION OFFICE and Cryptocurrency

You can guarantee that if you profit from Cryptocurrency, there will be some Tax to consider. As discussed previously, transacting in Cryptocurrency is not a secret transaction that is undetectable.

The Australian Taxation Office (ATO) Cryptocurrency data-matching program has been around since April 2019. Under the program, the ATO has collected data on cryptocurrency transactions for the 2014-15 to 2019-20 financial years. This protocol will continue onto the 2022-23 financial year.

Cryptocurrencies can be bought or sold on a digital currency exchange platform using traditional currency. In addition, some popular digital currencies or “stable coins”, like Bitcoin, can be purchased or sold for cash through special ATMs.

Tax treatment of Cryptocurrencies

If you are involved in purchasing or trading Cryptocurrency, you need to be aware of the tax consequences. These vary depending on the nature of your circumstances.

Everybody involved in buying, selling or trading Cryptocurrency needs to keep records of their cryptocurrency transactions.

If you’ve transacted with a foreign Cryptocurrency exchange, you may also have tax responsibilities in another country. This is an important thing to consider when you’re on the hunt for a reliable Crypto exchange. A few great ones are available in Australia, so you should research those over foreign exchanges.

Cryptocurrency Part Two: Crypto transactions & environmental impacts will expand on this topic further. This article talks about making transactions with Cryptocurrency and the types of taxes you may face when transacting with crypto, crypto mining basics, and the impacts crypto mining has on the environment. For example, do you know the amount of electricity Bitcoin miners use? The answer surprised me, and I’m sure it’ll be surprising for you too.

If you’re interested in finding out more about how to invest in Cryptocurrency and ensure you’re paying the correct taxes, feel free to contact us below, and we’ll happily show you your options.

The AUSTRALIAN TAXATION OFFICE and Cryptocurrency

The AUSTRALIAN TAXATION OFFICE and Cryptocurrency